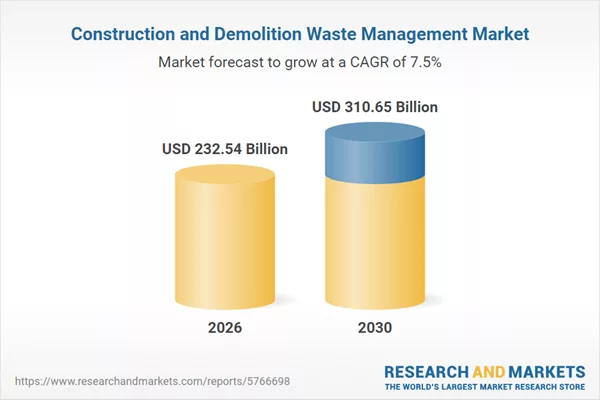

The construction and demolition waste management market has experienced steady growth, increasing from $216.3 billion in 2025 to $232.54 billion in 2026 at a CAGR of 7.5%. This growth is attributed to increased construction activities, demolition projects, rising waste generation concerns, and the expansion of infrastructure development. The sector’s importance continues to grow, with a projected expansion to $310.65 billion by 2030, maintaining a CAGR of 7.5%. This forecasted growth is fueled by sustainability initiatives, recycling efficiency, urban redevelopment projects, and eco-friendly disposal demand.

Key trends include a focus on recycling and waste recovery solutions, the adoption of sustainable practices, and a rising demand for efficient demolition waste handling. The construction industry’s expansion significantly propels market growth. CDWM plays a decisive role, promoting sustainability and resource efficiency by focusing on minimizing, reusing, and recycling vast amounts of waste from construction activities.

In December 2023, the U.S. Census Bureau reported that construction spending for October 2023 was expected to reach $2.02 trillion, marking a 0.6% increase from the revised September estimate and a 10.7% rise from the previous year. This sector’s expansion directly influences the waste management market.

Major industry players are prioritizing advanced solutions, such as low-speed shredders, to enhance recycling efficiency and sustainability. In January 2024, Vermeer Corporation launched the LS3600TX, a low-speed shredder designed for efficient recycling, processing materials like wood and construction debris while minimizing noise and energy consumption.

Company mergers signify strategic growth in the sector. In January 2023, CEMEX S.A.B. de C.V. acquired SHTANG Recycle Ltd. to bolster CEMEX’s commitment to sustainability through its Future in Action initiative, focusing on climate action, circularity, and resource management. SHTANG Recycle specializes in demolition, construction, and excavation waste recycling, enhancing CEMEX Regenera’s capabilities.

Leading companies in the market include Veolia Environnement S.A., WM Intellectual Property Holdings L.L.C. Inc., Republic Services Inc., and others. The Asia-Pacific region was the largest in the market by 2025, encompassing countries like Australia, China, India, and Japan. This market includes revenues from entities offering services such as landfilling, incineration, waste compaction, and composting. Revenues reflect the sale of services within specified geographies, excluding resales along the supply chain.